Gijs Graafland / Planck Foundation / Amsterdam / 2014

Secular Stagnation as Denial Term

The Global West has psychological problems in dealing with the ‘new normal’ of no growth that they entered when credit driven artificial growth reached it maximum and the mathematically certain attached consequence of economic contraction that this caused started. Not only in the economies/societies, but also in the realm of economic and monetary science too.

There are a lot of parallels in the way the Global West is dealing/coping with this ‘new normal’ and the Kübler-Ross model (see http://en.wikipedia.org/wiki/K%C3%BCbler-Ross_model) for psychological event responses. The Global West will need to go through all these 5 stages (denial, anger, bargaining, depression, acceptance) and they are still stocked very deep in phase 1: denial.

On of the signs of this denial of reality (and yes, also a sign of erosion of denial) is the term used in economic science as monetary science to describe this ‘new normal’ for the Global West and that term is “secular stagnation” (see https://www.google.com/search?q=secular+stagnation).

The term secular stagnation is a less offensive and somewhat fogging word for the hard reality of “economic stagnation” (http://en.wikipedia.org/wiki/Economic_stagnation), which is a term that nobody wants to hear so its rebranded to a less impact term. Secular stagnation is a marketing wrap on general stagnation, extending the state of denial as/while the consequences are hitting the surface.

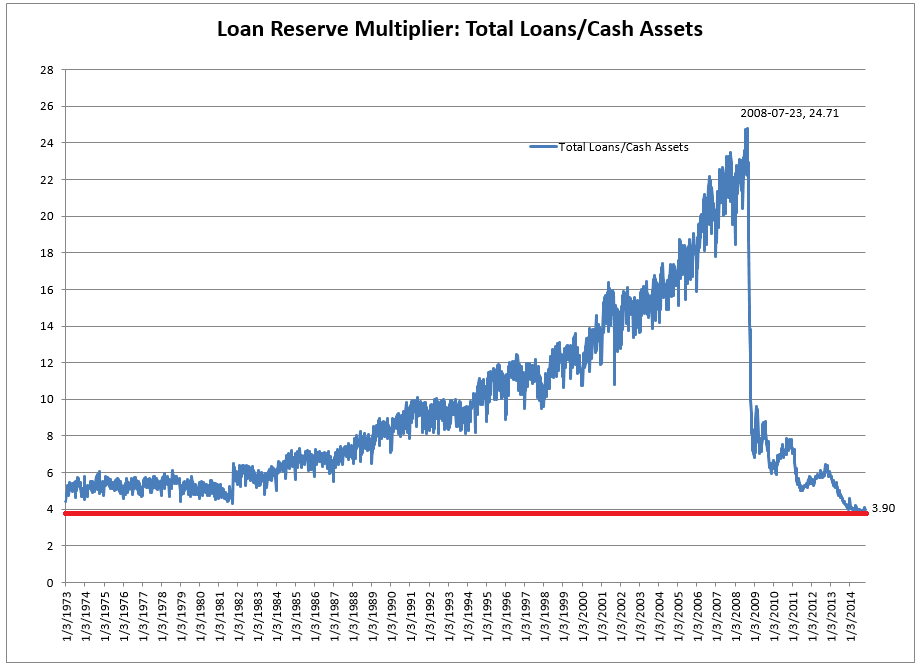

Still one look at this real data graph (http://www.planck.org/images/data-proof-of-the-end-of-artificial-credit-driven-growth-in-the-global-west.png) delivers a not easy to deny data based reality in just one graph. Credit driven artificial growth has a build-in end somewhere/sometime and the Global West reached it.

It seems very clear that this graph leaves no room for further denial of that something very important has been changed. But still the end of denial is far away. Why? As the consequences of acceptance are severe, making an ‘as long as it’s possible’ extending of denial very attractive for all policy makers in the Global West. There are severe external/geopolitical/geomonetary consequences (no longer being able to call the shots on the world scene, no longer being the center of the world, no longer operating the global reserve currency, no longer thriving by all those honours/advantages) that makes it difficult to leave the state of denial.

The Global West should no longer fool themselves: geopolitical and geomonetary dominance is not the result of some by undefined supra natural exceptionalism delivered influences, but just a result of current or earlier/former economic super performance. When this ‘above average’ economic performance disappears, the days of geopolitical and monetary dominance of the Global West are over soon. Although there’s a certain time delay between the those two events, the leadership dominance is build on a legacy of economic outperformance by the Global West of the Global Rest. These times are changing: The economic growth in the Global West is around 0%. The economic growth in the Global Rest is somewhere between 5 and 10%. Do the math regarding their respective perspectives. And don't forget important structural facets like growth of demographics and average age of demographics. Also don't forget the relative low private debt ratios and the relatively low governmental debt ratios (and that both also are supported by economic growth).

The Global West also should no fool themselves regarding that their former economic leadership position has brought them huge advantages that accumulated/stimulated their position even further as long they last. The Global West also should not fool themselves that these advantages as we speak fly out the window to other destinations where the economic sun is shining more brightly. To name one huge advantage that currently is flying away: being able to purchase any oil and any other energy/mineral resources and manufactured goods in the world in exchange for just your federal debt paper can’t be considered a small/minor advantage. Dissolving of such a huge advantage is not small beer.

The direct internal/national/domestic effects makes it even harder to do that: as these hit hard in the realm of every day reality for everyone. They shadows, interacts with and amplifies the international consequences.

As credit growth reaches its end the fake growth disappears overnight (see the above listed graph) and becomes real contraction. The flow/effect of credit gets in reverse mode: getting more credit is replaced by servicing old credit. The amortization and interest payments directly start to burden the real economy: leaving less money for the real economy. Payment power declines severely, not due to disappearance of the fake growth, but due that the debts that have funded the fake growth must be repaid (amortization and interests) without the help of credit growth that did this job before. The effect of this is severe and not that harmless. There a price in the future attached on consuming the fruits of the future today, on pulling the benefits of the future into the present, on hypothecation of the future. That price hits the Global West the last years and it’s not a small one nor it will reach the end of it soon: it has just started.

But there are huge indirect consequences of this credit contraction and its attached economic decline: these indirect consequences reaches two core industries that lives on / feed themselves by the real economy too: the financial industry and the governmental industry (the wide realm of government).

The end of credit growth first hits of course the financial industry. They were faced with a severe decline of loan quality (equals loan payment ratio) and by that a) get less cashflow than before and b) where not able to roll over old debts of debtors as before. The current design of the financial industry is based on endless growth. Why? As a loan is signed into existence, the money for the loan comes into existence too, as the banks created nearlt 97% of all money in circulation: money was/is created as debt. But the money for the interest payments is not created, that should be generated by economic growth. If economic growth is absent, it's mathematically certain that somewhere in the system defaults occur: there's is no money created to service in the interest on the debts. See the current financial system as a soufflé: as long it's in the heat all things are fine, but as soon the heat is gone the soufflé starts to implode. We have a money system based on endless growth as we thought that endless economic (and thereby monetary) growth was our destiny/perspective for ever. So the financial system imploded. And as they have sold themselves as core system mechanism, they demand to be saved by the state. Which doubled the state debts of all nations in the Global West. One problem postponed (nothing was solved), another problem created.

The end of credit growth has hit with some delay the governmental industry too. Not directly by less tax revenues due a declining economy and by slower tax payments do financial problems/stress by households and companies/corporations. It hit the governmental industry indirectly as governments thought that they must bail-out the banks in their dire straits. This doubled the debts of all nations in the Global West in no time. Using governmental money instead of QE to address the dire straits in the financial industry was not a too wise decision of the governments of the Global West. The financial industry would have solved this problem by central bank driven Financial QE. In the USA it's still the mainstream/general perception that that was move as the economy 'grows' again. But everyone who spend just one day out of glass bells called New York City or Washington DC knows better. The real economy is not saved, the financial economy is, and these two are some kind of different things. Unfortunately this is not that clear for those two detached of the rest of the nation 'economic islands'. The same could be said of the relation London and the rest of the UK, or Brussels and rest of Europe.

But it will get even worse soon for the Global West. The important factor of debt risk is not priced in into interest rates. As central banks are still able to set the interest rates (with or without the help of QE). But as one nation will go bankrupt this grip of the central banks on interest rates is history. Than the market (read: real risk) will determine the interest rates no matter what the central banks do or not do. Than the central banks are just out of ammunition: setting interest rates doesn't have real market impact anymore. Risk than becomes a market facet again (as it should be by the way). Interest rates will rise to the early 80ties levels of around 10%. Putting huge pressure on debt burden households and companies/corporations and thereby leading to a new wave of defaults washing away the capital reserves of the banks again, but this time with no government to help them. Why? As almost all governments have financed their long term federal state debt in short term loans (on advice of their fees earning funding partners). They have to roll over huge parts of their debt every year. Rolling it over at an around 10% interest rate leaves not that much over to spend on other things than interest, certainly as the real economy is in dire straits too and will not give that much 'milk' either.

There's even another game changing development emerging. People in the Global West start to save again. Buying on artificial purchase power is replaced by saving purchase power. People don't trust the good perspectives of the economy that much anymore, nor the government (for security on income, benefits and health care). Saving has become a mainstream development again, just as credit was before 2007. And the way people save is changed too: they start to avoid the financial industry. People apparently don't trust their financials (banks/investmentfunds/pensionfonds) that much any more. People redirect their old and new savings/reserves out of the financial institutions and start to save under own management (mortgage amortization, solar on the roof, mortgage help towards their kids, etc, etc).

So the economy grows no longer, the financial system is still on quick sand and the governments have hit the limits of tax revenues and debt funding. This all delivers a nice picture of the economic and monetary and governmental health of the Global West. But tthe main issue is no growth. That would not be a problem, if the financial system was not designed on eternal growth or if the state debts was not made with / based on the same idea of endless growth. But unfortunately both are based / build on this misperception. And denial prevents any needed change/solution to even reach the mind.

All these direct and indirect consequences have severe impact and will eventually with mathematically certainty wash out any soil under denial. But denial will not give up easily. Denial will not let go of the steering wheel unless it is forced to do so.

Still the most voluminous impact is unmentioned yet. This one is the fact that several decades of important economies are spend on chasing economic illusions. Leaving the economies of the Global West suddenly without those illusive economic driver and forcing them into the reality of real productive economies with credit no longer as tailwind, but as headwind (although as said: reality is a perception and denial is a bandage/warp on it). The Global West could have used those in heinsight negative years (as the only thing that's left are debts) also different in creating a more sustainable model. That's the hidden yet to surface deep impact consequence. The best example is the energy issue. If the Global West had spend their time in the economic sun, their windfall, their times with tail wind, their peace dividend on solving their energy issues they would have quite another future perspective than they have to do.

A complicating factor in ending this denial process is that an end of denial will erase the credentials of a whole ‘30 year long in office’ generation politicians, economists and monetary scholars. I will destroy the careers of many now very much honoured people. The ones that made the problem will never leave denial that easy, as doing that will take loads of courage than most of normal people have ('I was wrong most of my career' is not easy to say, certainly if your legacy is of an high/institutional level). It’s therefore no surprise that the ‘solutions’ most these oldies will stay to offer can be characterized by (using a quote of Einstein) ‘doing the same over and over again and expecting different results’ over and over again and again. Those oldies will not give up that easy: also for economic reasons: only those at the end of their career can afford paradigmatic change of views.

Denial will end when some of those oldies start to change there views a little bit (like the old US monetary system hegemony designer Larry Summers for example). These cracks in the denial story (caused by old brains that no longer are able to ignore the changes) will lead to the birth of a whole new generation of politicians, economists and monetary scholars. In the trail of the disclosers of them at the end of their economic/monetary careers, those of the old economic/monetary wave with still a substantial part of the career in front of them will read the signs of on the wall and will jump their views accordingly.

See also International Currency Stability

See also Europe: Diagnosis and Prescription

See also Governmental Funding Turbulence

See also Labour Taxation

See also Money Creation

See also Energy Open Finance Platform

See also Global PV Solar Energy Finance Model

See also EQE/EBS Model Summary Diagram

See also BQE: Bilateral Currency Swaps

See also Gold Backing vs EQE/EBS Backing

See also Secular Stagnation as Denial Term

See also Financial QE vs Productive QE

See also Productive Capitalism Perspectives

See also Emerging Nations - Electricity PPP

See also Emerging Nations - Solar PPP

See also Easy Instant Solarizing Nations

See also Making The Euro More Offensive

See also Structural EU/EC Boat Refugees Solution

See also Global Solar Rollout - Description - Diagram

See also Regional Solar Rollout - Description - Diagram

See also Obama Administration Energy Strategy

See also China As Global Leading Solar Energy Nation

See also Open Finance Platform for Energy Investments

See also Iceland 3.0: Geothermal and Energy as Currency

See also Addressing Economic Decline of the Global West

See also IntraContinental: Continental Rail Schedules

See also Global West Enters Economic Adulthood

See also Global East Driven Globalization 2.0

See also Financial Capitalism vs Productive Capitalism

See also CIRI (China India Russia Iran) Avoids Dollar

See also Global West Gets A Common Currency

See also What Ended Global West Dominance

See also National Economic Development Organizations

See also Desert Investment Economics

See also Ending Global Poverty (By Sea Water Irrigation)

See also Global Deserts Exploration Model

See also WaterTech and MicroCredit Merge

See also Lupin As Soy Replacer

See also Global Seed Cartels Aren't Right

See also Global Food Model: Local to Global

See also Sun / Earth Interactions

See also Telco 3.0 : Telco out of the Cloud

See also National Business Clusters Abroad

See also Scientific Education/Research Funding

See also Iran: National Economic Plan

See also Immigrants and Trade

See also Emerging Nations - Minerals PPP

See also Emerging Nations - Deserts PPP

See also Emerging Nations - Energy PPP

See also National Solar Fund Model

See also Secular Islamic Finance

See also Open Energy Finance Platform

Back to Main Site